If you're one of the 38 million Americans who receives SNAP benefits, you may have woken up on January 20th, 2019 with a surprise: you received an unexpected month's worth of SNAP benefits. Due to the government shutdown, states issued about $4.5 billion in February SNAP benefits earlier than usual — an impressive technical and operational accomplishment that required an all-hands-on-deck effort from the Department of Agriculture, state agencies, EBT processors, client advocates, and more. Many who have spent their careers working on SNAP quickly identified a challenge: SNAP participants across the country would have nearly two months between deposits, increasing the likelihood of the all-too-familiar empty cupboard towards the end of February.

“Because clients will have two months' worth of food dollars on their EBT cards this month, we urge them to plan and budget wisely. It is important for them to use January benefits in January, and February's benefits in February.”

-Dr. Kara Odom Walker, Delaware DHSS Cabinet Secretary in a public statement

Yet, past research shows that this type of hopeful budgeting is easier said than done. Due to our present-bias, most of us struggle when budgeting a large lump sum. We have a tendency to spend more than we should right after our payday and then have to penny-pinch at the end of our pay period (1). As a result, those who get paid only once a month (a large lump sum) do not budget as well as those who get paid twice a month (2).

In our own work with Common Cents Lab, a Duke-affiliated behavioral economics research group, we found that Providers users, who typically get their benefit deposit once every 30 days, tend to spend about 80% of their benefits within the first 9 days (3).

Now, SNAP recipients will face the extremely difficult task of budgeting two months of benefits (an even larger lump sum) over 40–60 days (4). State agencies and partners have worked furiously to raise awareness and encourage SNAP participants to budget.

“If you receive your February CalFresh benefits early, you should plan your food budget knowing that these benefits will be the only benefits provided through the end of February.”

Sample client communication sent by the California Department of Social Services to county offices

But when it comes to budgeting at any income level, “information isn't enough,” says Wendy De La Rosa, co-founder of the Common Cents Lab: “You can remind people a hundred times to make sure their benefits last through March, but you won't meaningfully change behavior. To reduce the temptation to spend, we have to change the environment and help people ‘hide' or ‘stash' their February benefits until it is time to use them.”

In fact, some SNAP recipients innately understood this basic principle — they want to “pretend” like their February benefits had not actually been deposited early, in order to try to make them last.

“The fs food stamps you get for February, don't touch them pretend they're not even there”

-Facebook user commenting in a public thread about early deposits

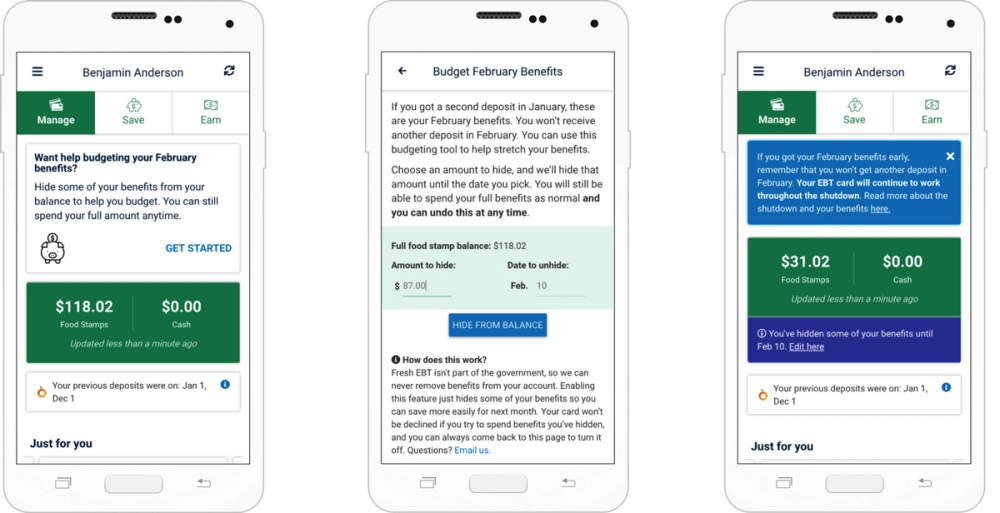

Working with Wendy, we built a tool designed to make this pretending easier. The tool is simple: Users opts-in by setting the amount they want to hide and for how long. There is no change to what they can actually spend on their card (we have no ability to do that), and we clearly message this so there's no confusion.

Providers's new budgeting feature

We hope this feature helps some of the 2 million households who use Providers to manage their benefits through this period of uncertainty.

Propel's mission is to build a stronger social safety net to enable low-income Americans to improve their financial health. Their free app, Providers, is used by over two million Americans across the country each month. Propel is a venture-backed for-profit company whose supporters include nonprofits, mission-oriented investors, and top-tier venture capitalists: Robin Hood Foundation, Omidyar Network, Andreessen Horowitz, and Kleiner Perkins. Propel is based in Brooklyn, N.Y.

Follow along as we work to build a stronger social safety net:

References

- Bodkin, R.G., 1959. Windfall income and consumption. American Economic Review 49(4), 602–614, and Beshears, J. and Milkman, K. 2008. Mental Accounting and Small Windfalls: Evidence from an Online Grocer. Harvard Business School — Working Paper 08–024.

- Berniell, I. (2016). Waiting for the paycheck: individual and aggregate effects of wage payment.

- De La Rosa, W. and Yeh, J. 2016. Managing SNAP (Food Stamps) Efficiently (Propel). Common Cents Lab Case Study. https://advanced-hindsight.com/archive/wp-content/uploads/2015/11/propel_case.pdf

- Most states spread out the distribution of benefits over the course of the month. If a participant's normal monthly deposit date is on the 20th of the month, she receives both her January and February deposit son January 20th and does not receive her next deposit until March 20th, she would go 60 days between deposits.