Important Coronavirus (COVID-19) Updates

- To receive stimulus funds, we recommend filing your taxes immediately,

- The IRS has extended the filing deadline until July 15th

Get free Volunteer Tax Assistance, online or in person.

Your household could save thousands of dollars this season by using free tax prep services and applying tax credits. Read on for eligibility requirements and next steps for finding:

- Free in-person tax help.

- Free online tax help.

- Tax credits.

- Info about food stamps and taxes.

Volunteer Income Tax Assistance (VITA)

What is it?

VITA is an IRS-run program that offers free tax help at local community and neighborhood centers, libraries, schools, and malls all over the country. VITA site volunteers can also connect you with financial coaches and recommend other ways to save money beyond tax season.

Am I eligible?

If your household makes $56,000 or less, you're eligible. It's that simple!

Ok, I'm in! What’s next?

The next step is to figure out two things: where to go and what to bring.

What to bring: This IRS checklist explains everything you need to bring with you to a VITA center.

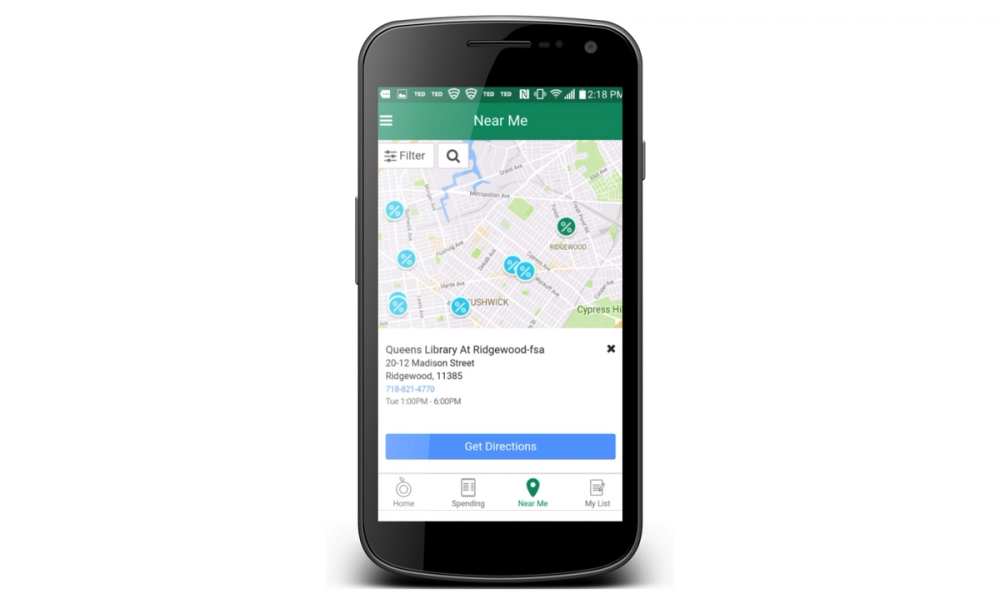

Where to go: Download Providers and open the map to find a VITA site near you (as well as nearby stores and farmers’ markets that take EBT). You don't need an account to use the map.

Tax Counseling for the Elderly (TCE)

What is it?

TCE is an IRS-run program that offers free tax help for people 60 and older.

Am I eligible?

If you’re 60 or older, you’re eligible!

Ok, I'm in! What’s next?

What to bring: This IRS checklist explains everything you need to bring with you to a TCE center.

Where to go: This IRS locator can help you find a TCE site near you.

Low-Income Taxpayer Clinics (LITC)

What is it?

Have you received a letter from the IRS that's difficult to understand or you believe contains false information? LITCs are programs at law schools and legal firms that offer free legal representation for people who need to resolve a dispute with the IRS, such as:

- You were denied an earned income or child tax credit, and you want to fight this decision.

- You owe back taxes and need help figuring out a payment plan with the IRS.

- Your employer hasn't given you official documentation.

Am I eligible?

Check out this IRS chart to find out if you qualify for LITC help.

Ok, I'm in! What’s next?

The next step is to use this IRS locator to find LITC centers near you.

How to get free online tax help.

IRS Free File

What is it?

IRS Free File lets you file your taxes online for free with leading tax prep software, like H&R Block, Turbotax, and others.

Am I eligible?

If your household makes $69,000 or less, you’re eligible!

Ok, I'm in! What’s next?

Use the Free File Lookup Tool to figure out which free file offer is best for you.

Tax credits you might qualify for.

Earned Income Tax Credit (EITC)

What is it?

The EITC is a benefit for working low-income households that reduces the amount of taxes you owe. If your credit is more than the amount you owe in taxes, you’ll get a refund check for that difference.

Am I eligible?

This table gives a general overview of EITC eligibility, but there are exceptions. Use the EITC Assistant to find out if your specific household is eligible for the EITC credit.

| 0 | $529 | $15,570 | $21,370 |

|---|---|---|---|

| 1 | $3,526 | $41,094 | $46,884 |

| 2 | $5,828 | $46,703 | $52,493 |

| 3+ | $6,557 | $50,162 | $55,952 |

Ok, I'm in! What’s next?

Your in-person or online tax preparer will walk you through next steps.

The Child and Dependent Care Tax Credit (CDCTC)

What is it?

The CDCTC is a tax credit for working people who have paid someone to care for a child or other dependent.

Am I eligible?

If you’ve paid for childcare or dependent care, you’re most likely eligible. You aren’t eligible if the person you paid for care was your spouse, ex-spouse, a child under 18, or anyone listed as a dependent on your tax return.

Ok, I'm in! What’s next?

Your in-person or online tax preparer will walk you through next steps.

Child Tax Credit (CTC)

What is it?

The CTC is a tax credit worth up to $2,000 per child.

Am I eligible?

If your household makes $69,000 or less, and you provided at least half the child’s support over the last year, you’re eligible!

Ok, I'm in! What’s next?

Your in-person or online tax preparer will walk you through next steps.

Do food stamps affect your taxes?

Food stamps don’t count as taxable income, so they don’t affect your taxes. The only benefit you need to report on your tax return is unemployment assistance.

In case you haven’t already, download Providers to instantly check your food stamp balance and explore opportunities to save and earn money!